Господдержка предприятий-производителей строительных материалов

The criteria for small and medium-sized businesses will change. This follows from the order of the President of the Russian Federation of April 11.

In particular, Putin instructed to change the criteria for classifying businesses as small and medium enterprises. It is including the number and income.

New rules will be established in agreement with the business. The changes will improve the position of taxpayers.

“With the participation of representatives of the business community, to work out the issue of improving the criteria for classifying business entities as small and medium-sized enterprises, including the establishment of the dependence of the maximum values of the average number of employees and income derived from entrepreneurial activity on the scope of activities”, - said on the Kremlin website.

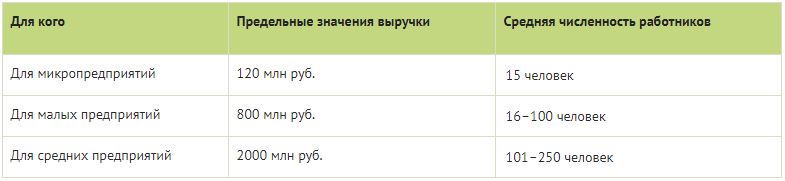

Main criteria for small business - table for 2020

Please note that PIs must also meet these criteria.

List of instructions following a meeting with representatives of the business community

Vladimir Putin approved the list of instructions following a meeting with representatives of the business community on March 26, 2020.

April 11, 2020 20:00

To the Government of the Russian Federation:

a) implement additional measures aimed at supporting socially oriented non-profit organizations participating in activities to support citizens in connection with the spread of a new coronavirus infection;

b) consider the possibility of supporting and developing online services for the delivery of finished catering, including by partially subsidizing small and medium-sized businesses to the cost of delivery during the spread of a new coronavirus infection.

Deadline is May 15, 2020;

c) to consider the possibility of procuring in the II quarter of 2020 certain types of goods, work, services planned for the second half of 2020;

d) with the participation of representatives of the business community, to work out the issue of improving the criteria for classifying business entities as small and medium-sized businesses, including the establishment of the dependence of the maximum values of the average number of employees and income derived from entrepreneurial activity on the scope of activities;

e) to work out the issue of phased payment of taxes and advance payments of taxes for taxpayers classified as small and medium-sized businesses and operating in sectors of the Russian economy that are most affected by the spread of a new coronavirus infection and insurance contributions to state extra-budgetary funds for microenterprises operating in the sectors of the Russian economy that have been most affected by the spread of new ronavirusnoy infection term payment which must be extended in accordance with earlier data request, and if necessary also the possibility of further extension of this period.

Deadline - April 30, 2020;

f) ensure the introduction of amendments to the legislation of the Russian Federation on taxes and fees, providing for:

the inclusion by taxpayers in 2020 of non-operating expenses when determining the tax base for corporate income tax expenses in the form of the cost of food products (excluding alcohol and tobacco products), donated to charitable and socially oriented non-profit organizations;

features of accounting in 2020 of the amount of value added tax paid in transactions with these goods;

g) to consider introducing into the Regulation on the peculiarities of cancellation, replacement or reschedule of an entertainment event organized by an organization or a museum, including regarding the procedure and terms for reimbursing the cost of tickets, season tickets and excursion tickets for such events, if there is a threat of and (or ) the occurrence of certain emergency situations, the introduction of a high alert or emergency situation throughout the Russian Federation or in part of its changes, providing for an increase the deadlines for returning the full cost of a ticket, subscription or sightseeing tour ticket for cancellation of entertainment events organized by the performing arts organization or museum, to the visitor on his initiative until the calendar year from the date of cancellation of the entertainment event, and when transferring a entertainment event - only exchange for a ticket, subscription or sightseeing a trip with a later date;

h) to study the development of information platforms for online education, considering the mechanisms for their support, as well as options for users to pay for their services.

Deadline is May 20, 2020.

Responsible: Mishustin M.V.

Source: Simplified Professional Edition for Accountants